Skier Visit Stats that may surprise you

Here are some excerpts from an interesting paper which discusses the trends of skier visits world wide. Although this does not pertain directly to backcountry skiing you could extrapolate that the trends would likely be similar. Have a read, you may be surprised.

2013 International Report on Snow & Mountain Tourism

Overview of the key industry figures for ski resorts

by: Laurent Vanat

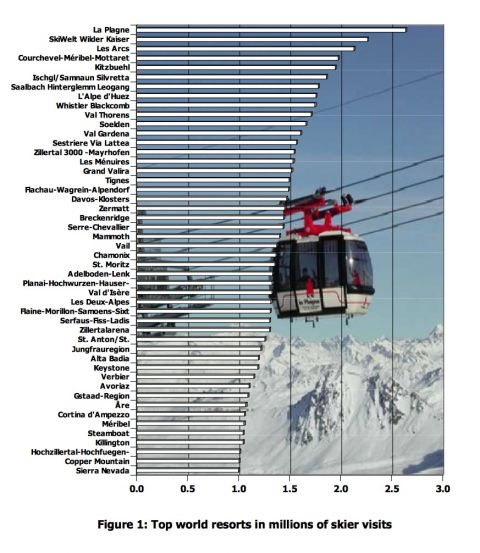

The major ski resorts worldwide have been ranked below on the basis of their average annual skier visits5 during the last few winter seasons.

(click for larger views of each graphic)

Most of the industry is concentrated around the resorts that generate more than 100’000 skier visits per year. Even if they only account for 20% of the resorts, they account for 80% of all skier visits.

Although often important at a regional level, the altitude of a ski re- sort is not really an important benchmark worldwide, since at some places around the globe one can ski at sea level, whereas in other countries, one needs to be at the higher elevations to access decent snow conditions.

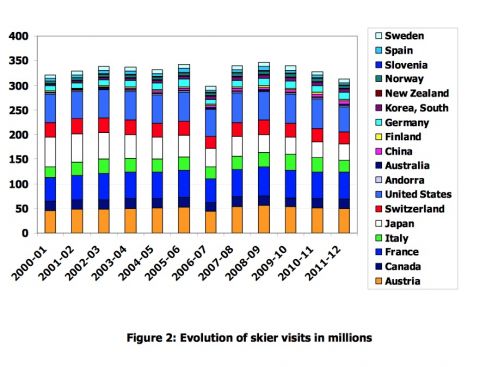

Evolution of worldwide skier visits

Although data collection within the industry is not always well organized and yearly number of visits may vary due to weather conditions, for several years the estimate has been an overall draw of approximately 400 million skier visits worldwide6. The assumption is that figures have been stable over the last 10 years, as major mature markets experienced reduced growth (when not experiencing a dramatic decline as with Japan), while other markets were emerging.

The chart below appears to confirm this assumed trend, and reflects the evolution of skier visits in those countries considered to be a large sample7 of the most significant industry players over the last decade.

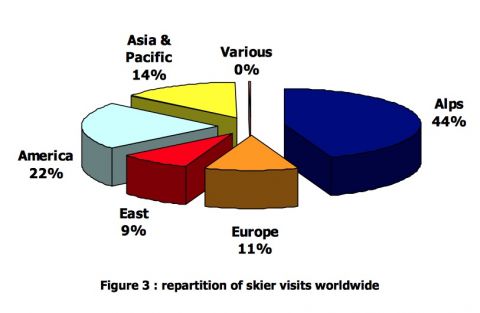

Market share of worldwide skier visits

The relative importance of the major destinations is showed in the pie chart below. Clearly, the Alps are the biggest ski destination in the world, capturing 44% of skier visits. The second biggest destination is America (mostly North America), accounting for 22% of skier visits worldwide.

Asia & Pacific used to have the same market share as America. How- ever, the continuous decline of the industry in Japan has still not been replaced by the growing ski markets in South Korea and China. In the long term, countries such as India and Pakistan may join them and contribute to increasing the weight of Asia in the international spread of skier visits. Northern, Southern and Western European non alpine countries (grouped under the label of Western Europe) also attract 11% of the market, even if skier visits are spread primarily over a large number of small resorts.

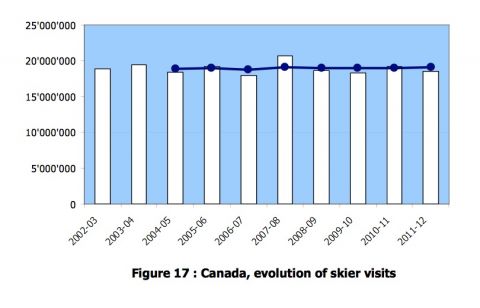

Canadian Skier Visits

Skiing in Canada is located in the Rocky Mountains of the West and in the Québec, Ontario and Atlantic27 provinces of the East. While the Rockies have ski resorts that can compete with the Alps in terms of vertical drop, skiing in the East takes place on lower altitude mountains and hills.

With a long ski history, Canada has a mature market, with serious concerns about an ageing clientele and the ability to renew the customer base, featuring also interesting ethnic issues. Skier visits have been flat for the last decade, mostly due to weather conditions. Last year’s ski season in Canada was heavily affected by poor snow conditions that impacted the industry throughout all of North America. The beginning and end of the season had little to no snow and warm weather caused early or temporary resort closures. Attendance totalled 18.15 million skier visits.

Market studies show that the number of skiers continues to decline. The purchasing behaviour of most skiers has been influenced by the crisis. They have more actively sought out deals or to ski close to home. Some still say that weather and poor snow conditions are the prevailing cause.

The Canadian ski resorts depend on a domestic and U.S. customer base. It is interesting to stress that some of the well-known resorts, such as Whistler Blackcomb, Banff and to a lesser extent Tremblant, also attract some overseas skiers, even if the proportion of foreign visitors is relatively low. Furthermore, some very small resorts also appear to attract British tour operators. Intrawest is the only significant multi-resort operator. Otherwise, operators are mostly local.

Due to weak growth in recent years, the Canadian ski industry has conducted detailed studies about the demographics, implementing the Model for Growth. Several operators have also diversified their activities and some of the major resorts now offer numerous summer activities that enable them to balance out visits for both seasons. The idea of a year-round resort has been highly developed and promoted. Some resorts near metropolitan areas have developed water rides and other such summer activities, which even allow them to use some of the lifts during the summer, as well as to sell year round passes.

United States Skier Visits

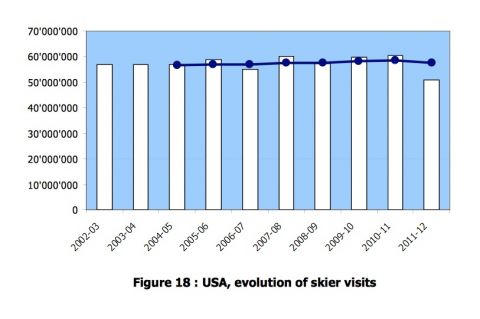

The United States represents the largest ski market, with a high number or resorts and the highest attendance figures on average. The industry is dominated by several big players, operating several mostly integrated resorts. In addition, it has numerous independent ski areas of varying sizes. Nevertheless, due to closures and other misfortunes, the number of ski areas has been steadily decreasing over the years. At the beginning of the 1980’s, there were over 700 ski resorts in operation, whereas there are only about 480 ski areas still in operation today.

2013 International Report on Snow & Mountain Tourism – Overview of the key industry figures for ski resorts April 2013

The United States ski industry has been the most closely analyzed ski industry over the years. There is a substantial history of statistical data available. It was the first in the industry to raise issues in the discrepancies between population growth and skier visits, especially since it primarily depends on domestic participation. In spite of its huge population, the participation rate is estimated at only 3% to 4%.

Aside from the 2008 crisis, weather conditions have shaped, more than anything else, the change in skier visits over the years. Skier visits through the beginning of the decade reinforced the trend of a mature market since the end of the 1970’s. However, things began to change over the last 5 years, with 3 very good seasons, leading to a recent growth trend up to the 2011/12 season.

After having set a new all-time record of 60.5 million skier visits for the 2010/11 season, the 2011/12 winter saw a drop in attendance figures unheard of seen since 1991/92. With only 51.0 million skier visits the industry experienced a nearly 16% decline from the season before. Low snowfall – 41% down on average from the prior season – and record warm temperatures in all regions caused a decline in visits for 83% of the ski areas in the United States.

If you want to read the complete report it can be found over here: ropeways.net/rnn/konfig/uploads/pdf/53.pdf